Blog

What College Students Need to Know About Money

Submitted by Robert Gordon & Associates, Inc on October 14th, 2020

College represents a time of independence in a young adult’s life. It may be the first time that your child has almost complete control over their own finances. From deciding how to use their spending money to deciphering student loan options, it can be difficult for students to adjust to the financial side of college living.

Retiring as a Small Business Owner

Submitted by Robert Gordon & Associates, Inc on October 14th, 2020

There are over 30 million small businesses in the United States. Many people start their own businesses in order to become their own boss and take control over their schedules, career goals and finances. It can be incredibly rewarding to start and own a successful small business. But one thing that many small business owners may not think about is a retirement plan.

Preparing for an Early or Unexpected Retirement

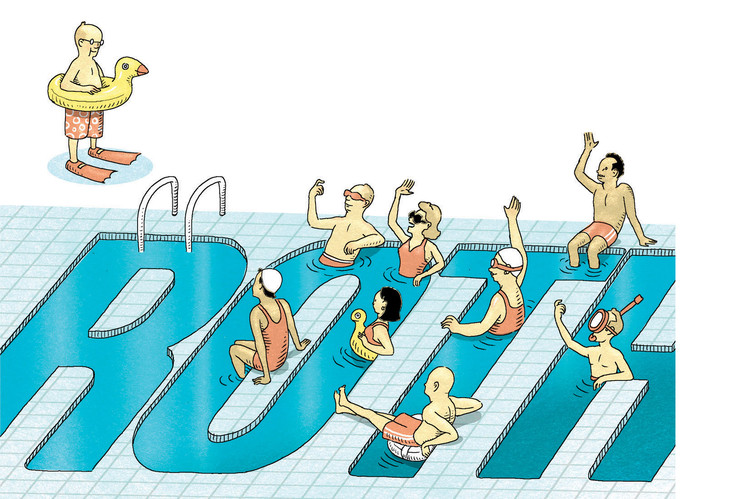

Submitted by Robert Gordon & Associates, Inc on September 23rd, 2020The Pros and Cons of a Roth IRA Conversion

Submitted by Robert Gordon & Associates, Inc on July 21st, 2020

Taxes, whether we admit it or not, drive a lot of our personal finance decisions. Avoiding or lowering them can influence where we choose to live, what kind of car we buy, where we send our children to school, whether we purchase a house, and many other everyday decisions. Everyone tries to limit the amount of taxes they pay. Taxes play a large role when we invest for retirement, as well.

5 Reasons Roth IRAs Won’t Be Taxed

Submitted by Robert Gordon & Associates, Inc on July 20th, 2020Student Loan Borrowers May Get Relief Amid Covid-19 - What To Know

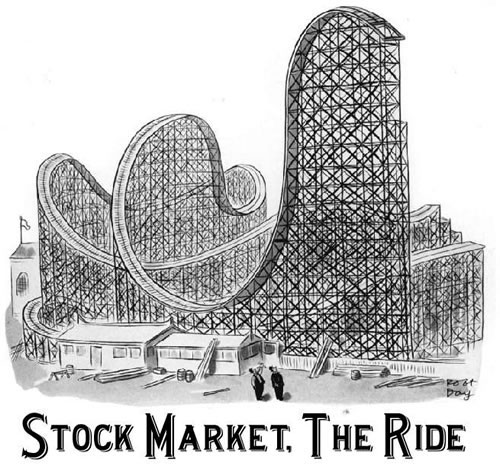

Submitted by Robert Gordon & Associates, Inc on March 30th, 2020Managing Emotions and Expectations during Market Uncertainty

Submitted by Robert Gordon & Associates, Inc on March 27th, 2020

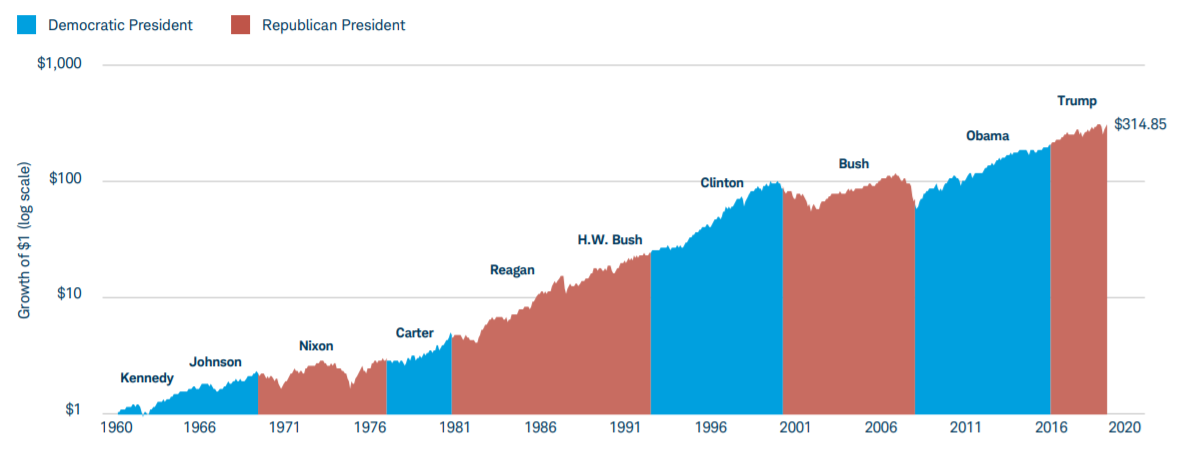

Riding the highs, and experiencing the lows, it is the way of the investment market. However, what if we told you that the key to sound and quality investing is learning how to keep cool when the market is in turmoil? In this article, we look at some of the techniques that can help you manage your emotions and expectations during market uncertainty.