Blog

Mega Backdoor Roth: What It Is and How It Works

Submitted by Robert Gordon & Associates, Inc on April 17th, 2023

If you're looking for a way to save more for retirement than what traditional 401(k) or IRA accounts allow, a mega backdoor Roth might be worth considering. This is a strategy that enables individuals to contribute significantly more after-tax dollars to their retirement accounts than they would be able to otherwise.

It's Never Too Late to Save for Retirement

Submitted by Robert Gordon & Associates, Inc on January 19th, 2023Secure Act 2.0 - What's It All About?

Submitted by Robert Gordon & Associates, Inc on January 19th, 2023Five Steps to Recession-Proof Your Finances

Submitted by Robert Gordon & Associates, Inc on September 16th, 2022‘Just stop buying lattes’: The origins of a millennial housing myth

Submitted by Robert Gordon & Associates, Inc on July 18th, 2022Why recessions are inevitable

Submitted by Robert Gordon & Associates, Inc on July 18th, 2022How Does the SECURE Act Impact Saving After Age 70?

Submitted by Robert Gordon & Associates, Inc on July 18th, 2022

You're never too old to keep saving. And now the SECURE Act gives you added incentive—even past age 70.

According to a recent GALLUP survey, 63% of Americans plan on working part-time in retirement. And I think that makes a lot of sense. After all, working part-time not only provides some extra income, it’s also a way to stay active and engaged.

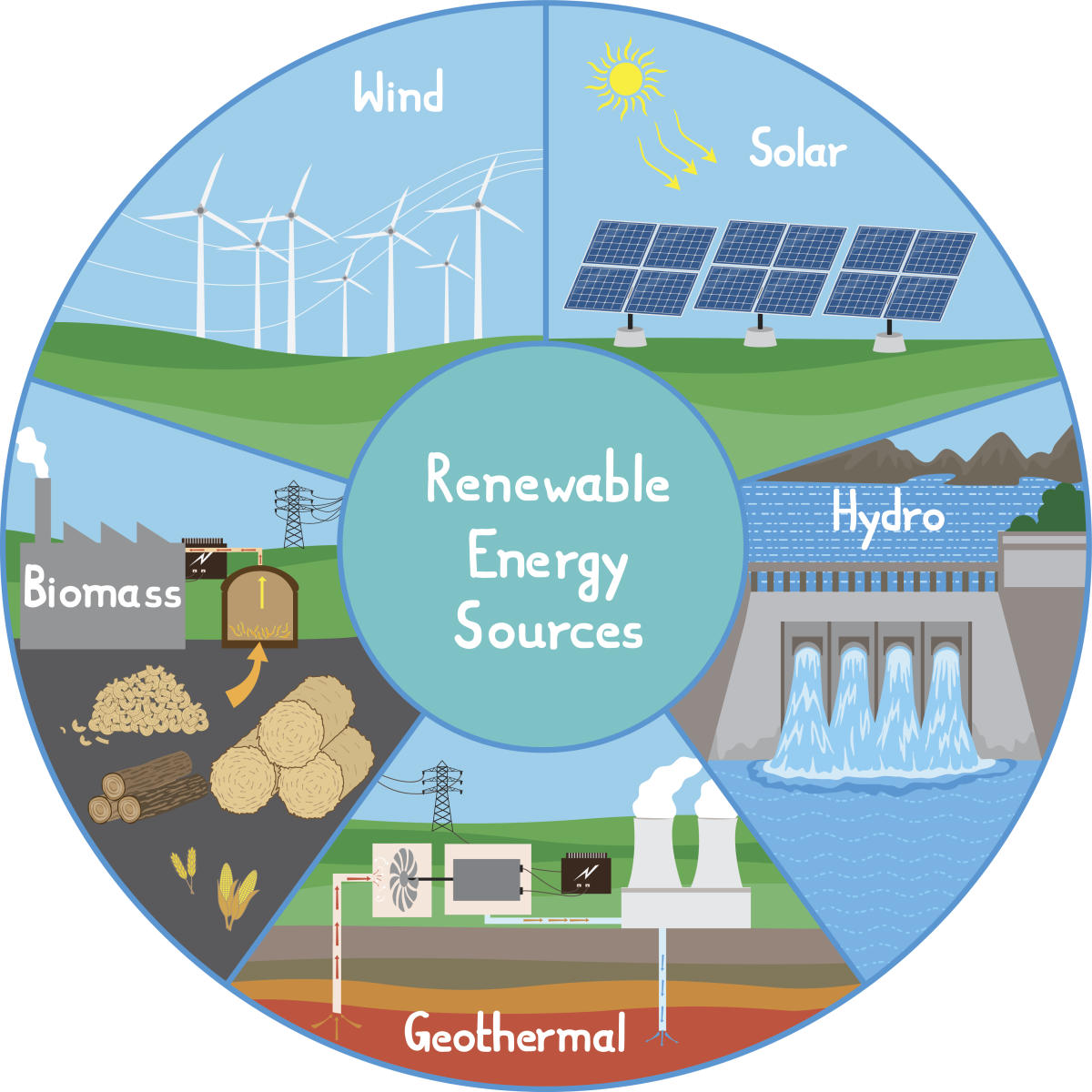

What Are the Five Major Types of Renewable Energy?

Submitted by Robert Gordon & Associates, Inc on June 30th, 2022Ready, Set, RMDs Are Back On Track For 2021

Submitted by Robert Gordon & Associates, Inc on March 16th, 2021

The year 2020 is one of the most eventful in recent times, and changes to the rules that govern retirement accounts are no exception. One of these changes is the waiver of required minimum distributions (RMDs) for 2020. As a result of this waiver, you are not required to take RMDs from your IRA for 2020.