Savings

Why recessions are inevitable

Submitted by Robert Gordon & Associates, Inc on July 18th, 2022How Does the SECURE Act Impact Saving After Age 70?

Submitted by Robert Gordon & Associates, Inc on July 18th, 2022

You're never too old to keep saving. And now the SECURE Act gives you added incentive—even past age 70.

According to a recent GALLUP survey, 63% of Americans plan on working part-time in retirement. And I think that makes a lot of sense. After all, working part-time not only provides some extra income, it’s also a way to stay active and engaged.

Ready, Set, RMDs Are Back On Track For 2021

Submitted by Robert Gordon & Associates, Inc on March 16th, 2021

The year 2020 is one of the most eventful in recent times, and changes to the rules that govern retirement accounts are no exception. One of these changes is the waiver of required minimum distributions (RMDs) for 2020. As a result of this waiver, you are not required to take RMDs from your IRA for 2020.

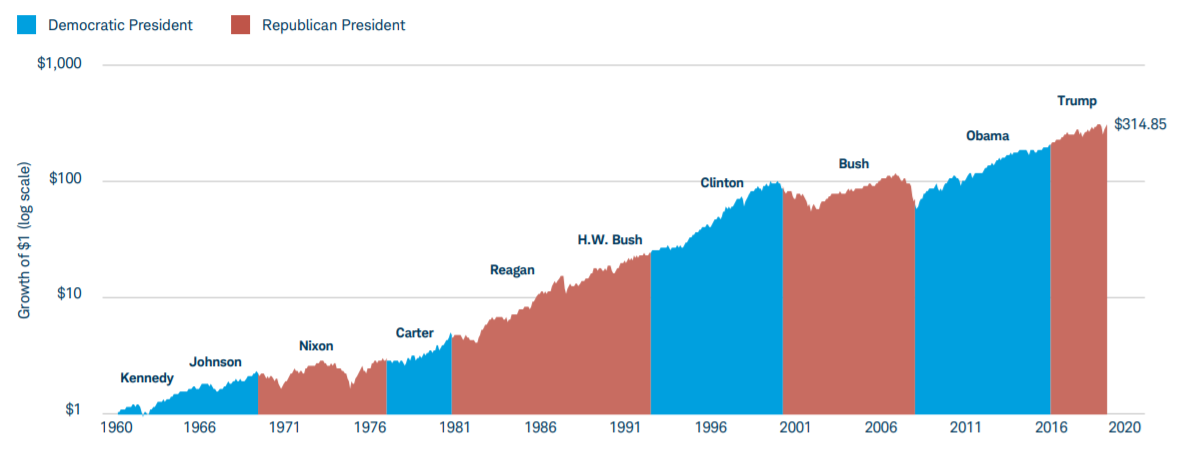

Does the Stock Market Favor a Republican or Democrat President?

Submitted by Robert Gordon & Associates, Inc on October 14th, 2020What College Students Need to Know About Money

Submitted by Robert Gordon & Associates, Inc on October 14th, 2020

College represents a time of independence in a young adult’s life. It may be the first time that your child has almost complete control over their own finances. From deciding how to use their spending money to deciphering student loan options, it can be difficult for students to adjust to the financial side of college living.

Retiring as a Small Business Owner

Submitted by Robert Gordon & Associates, Inc on October 14th, 2020

There are over 30 million small businesses in the United States. Many people start their own businesses in order to become their own boss and take control over their schedules, career goals and finances. It can be incredibly rewarding to start and own a successful small business. But one thing that many small business owners may not think about is a retirement plan.

The Pros and Cons of a Roth IRA Conversion

Submitted by Robert Gordon & Associates, Inc on July 21st, 2020

Taxes, whether we admit it or not, drive a lot of our personal finance decisions. Avoiding or lowering them can influence where we choose to live, what kind of car we buy, where we send our children to school, whether we purchase a house, and many other everyday decisions. Everyone tries to limit the amount of taxes they pay. Taxes play a large role when we invest for retirement, as well.

5 Reasons Roth IRAs Won’t Be Taxed

Submitted by Robert Gordon & Associates, Inc on July 20th, 2020What is a Health Savings Account?

Submitted by Robert Gordon & Associates, Inc on October 11th, 2018

Let’s face it, medical expenses can have a major impact on your budget, especially as you get older.

If you’ve heard about a Health Savings Account or maybe your work offers one, then it just may make sense to give it some serious consideration – and, in my opinion, it typically makes a lot of sense.