What you don't know about your parents' retirement plans could hurt you financially

Submitted by Robert Gordon & Associates, Inc on February 13th, 2020

Most working Americans have no clue how prepared their parents are for retirement, a knowledge gap that could hurt their own finances.

About 7 in 10 adults between 25 and 44 years old said they know little to nothing about their parents’ finances. But nearly the same share expect they will need to financially help their parents if they outlive their savings.

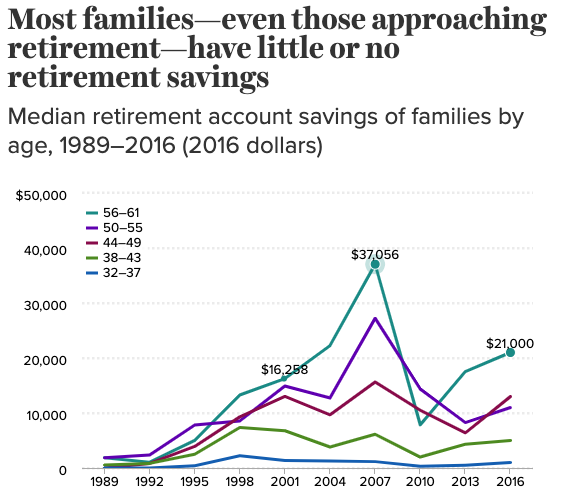

This discrepancy comes at a time when those nearing retirement and their adult children are both vastly behind on saving for retirement. The median amount saved by those between 56 and 61 is around $21,000. For the retirement generation before, there were defined-benefit plans such as a pension. This is the first generation where 401(k)s could make the bulk of retirement savings.

The future of Social Security benefits and longer lifespans also worry many Americans when they think about their parents’ retirement. About 7 in 10 Americans believe Social Security won’t be a reliable source of income when their parents reach their 90s.

Recent research by the Social Security Administration highlights that trust fund reserves will be depleted starting in 2035 when the oldest baby boomers turn 89, and only 80% of the program’s costs will be funded. This could mean reduced benefits for retirees.

Half of respondents believe at least one parent will live into their 90s, while 3 in 5 worry about their parents running out of money in their later years. Trends in longevity really have changed. The average lifespan has gotten longer and it's not unheard of for people to live into their mid-90's or early 100's.

Children stepping in

4 in 5 adult children agreed they need to consider the needs of their parents and in-laws when planning their own long-term financial plans. But just over a third have done so. If children don’t address the financial elephant in the room with their aging parents, the trickle-down effects include setbacks to their own goals. If they find out they need to help their parents with retirement or long-term care expenses, they will have to dial back on their own retirement contributions or even their educational savings for their kids.

But not all consequences are financial. A lack of transparency can simply erode trust between generations. If these issues are ignored, that’s going to build up resentment even within the most generous and well-intentioned people. This is often due to seeing your own personal objectives taking a step back.

Having the conversation

Talking to parents about their personal finances is the second most awkward subject for adults, but experts say there are ways of alleviating the uncomfortable feeling. The first step is reframing the discussion as soon as possible.

Taking a holistic view of retirement readiness will have you be more prepared. Having the initial conversation 10 to 15 years before the parents’ retirement allows you to think of it as an activity around goal-setting.

Financial advisors also recommend asking if your parents have a reliable financial plan. You can ask them if they have a plan to create predictable income during retirement years. Turning your lifetime savings into income is a difficult task to feel confident about.

Another tip is asking if your parent’s retirement plans consider unexpected expenses. If you are fairly healthy, you can expect to live past 85, so, in that case, you should be realistic about retirement projections covering risk of inflation as well as healthcare costs.

If you’re still struggling to approach the conversation, remember that having the conversation now will make it easier for future family conversations. Approach the conversation from a place of love and family support.

Parents’ responsibilities

While it may fall to millennials and Gen X'ers to initiate the financial conversation, their parents should do their part to shore up their finances as much as possible before their golden years.

As a starting point, they can take advantage of catch-up contributions to retirement accounts. For instance, those above 50 can contribute an extra $6,500 to their 401k's, above the $19,500 contribution limit for 2020. They can also sock away an additional $1,000 to IRA accounts on top of the $6,000 limit for 2020.